des moines new mexico sales tax rate

Collegesuniversities with over 2000 students nearest to Des Moines. 700 2022 Des Moines County sales tax Exact tax amount may vary for different items Download all Iowa sales tax rates by zip code The Des Moines County Iowa sales tax is 700 consisting of 600 Iowa state sales tax and 100 Des Moines County local sales taxesThe local sales tax consists of a 100 county sales tax.

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

A county-wide sales tax rate of 1 is applicable to localities in Des Moines County in addition to the 6 Iowa sales tax.

. Instead of the rates shown for the Des Moines tax region above the following tax rates apply to. The Des Moines sales tax rate is. The December 2020 total local sales tax rate was 10000.

The Des Moines Sales Tax is collected by the merchant on all qualifying sales made within Des Moines. The Des Moines County Sales Tax is 1 A county-wide sales tax rate of 1 is applicable to localities in Des Moines County in addition to the 105 Puerto Rico sales tax. The US average is 46.

Look up 2021 sales tax rates for Des Montes New Mexico and surrounding areas. 9000 7377 Des Moines government finances. For tax rates in other cities see Iowa sales taxes by city and county.

To review these changes visit our state-by-state guide. In an effort to recover lost tax revenue tax delinquent property located in Des Moines New Mexico is sold at the Union County tax sale. Tax rates are provided by Avalara and updated monthly.

The property is sold to the successful bidder state laws differ though often it is sold for the amount of unpaid taxes. While many other states allow counties and other localities to collect a local option sales tax Iowa does not permit local sales taxes to be collected. The current total local sales tax rate in Des Moines WA is 10100.

- The Median household income of a Des Moines resident is 28594 a year. Tax - General Sales and Gross Receipts. 100 US Average.

The US average is 28555 a year. Has impacted many state nexus laws and sales tax collection requirements. The 7 sales tax rate in West Des Moines consists of 6 Iowa state sales tax and 1 Polk County sales tax.

The 60625 sales tax rate in Des. While many other states allow counties and other localities to collect a local option sales tax New Mexico does not permit local sales taxes to be collected. The minimum combined 2022 sales tax rate for Des Moines Washington is.

West Des Moines Iowa and Albuquerque New Mexico Change Places. The County sales tax rate is. Sales tax region name.

The Des Moines County Sales Tax is 1. - Tax Rates can have a big impact when Comparing Cost of Living. Below 100 means cheaper than the US average.

- The Income Tax Rate for Des Moines is 49. 1000 Is this data incorrect. The estimated 2022 sales tax rate for 98198 is 101.

New Mexico Highlands University about 112 miles. Real property tax on median home. The West Des Moines Sales Tax is collected by the merchant on all qualifying sales made within West Des Moines.

Some cities and local governments in Des Moines County collect additional local sales taxes which can be as high as 88817841970013E-16. Income and Salaries for Des Moines - The average income of a Des Moines resident is 17526 a year. The Washington sales tax rate is currently.

The Des Moines Iowa sales tax is 600 the same as the Iowa state sales tax. For Des Moines homes valued at 150000 under the 2021 fiscal year rollback a 40-cent rate cut would save residents 81 in what they pay to the city. 3 rows 61875 lower than the maximum sales tax in NM.

You can print a 7 sales tax table here. Des Moines Sales Tax. This is the total of state county and city sales tax rates.

Heres how Des Moines Countys maximum sales tax rate of 7. While many other states allow counties and other localities to collect a local option sales tax Iowa does not permit local sales taxes to be collected. Sales Tax on Food.

The Des Moines sales tax rate is 7. The West Des Moines Iowa sales tax is 600 the same as the Iowa state sales tax. There is one additional tax district that applies to some areas geographically within Des Moines.

The Des Moines Sales Tax is collected by the merchant on all qualifying sales made within Des Moines. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The Des Moines New Mexico sales tax is 513 the same as the New Mexico state sales tax.

A 20-cent decrease would save 6545 while a. There is no applicable city tax or special tax. None of the cities or local governments within Des Moines County collect additional local sales taxes.

The 2018 United States Supreme Court decision in South Dakota v.

Gross Receipts Location Code And Tax Rate Map Governments

Ebay Sales Tax Everything You Need To Know Guide A2x For Amazon And Shopify Accounting Automated And Reconciled

Cryptocurrency Taxes What To Know For 2021 Money

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Illinois Sales Tax Rates By City County 2022

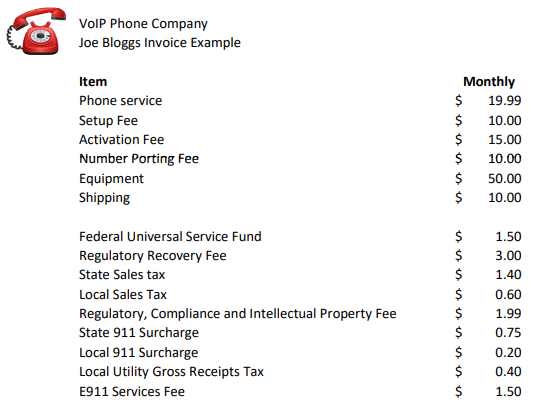

Voip Pricing Taxes And Regulatory Fees Explained

Hotel Prices Why Urban Hotels Cost So Much More Than Houses Or Apartments In The Same City

Seattle Washington S Sales Tax Rate Is 10 25

Gross Receipts Location Code And Tax Rate Map Governments

New Mexico Sales Tax Rates By City County 2022

Ebay Sales Tax Everything You Need To Know Guide A2x For Amazon And Shopify Accounting Automated And Reconciled

Louisiana Sales Tax Rates By City County 2022

Which Countries Have The Highest Taxes For The Rich And I M Talking About The Taxes Of The Highest Income Brackets So Not The Average Income Taxation Percentage Of A Country Quora

Sales Tax Rates In Major Cities Tax Data Tax Foundation

This Is The Most Expensive State In America According To Data Best Life